Marriott International Class A Common Stock

MARMarriott International Class A (MAR) is a leading global hospitality company known for its extensive portfolio of hotel brands. Founded in 1927, it operates and franchises a wide range of properties across luxury, premium, and select-service segments. Marriott is recognized for its commitment to service, innovation, and loyalty programs, making it one of the largest and most prominent players in the hospitality industry worldwide.

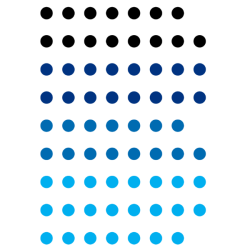

Dividend History

| Pay Date | Amount | Ex-Date | Record Date |

|---|---|---|---|

| December 31, 2025 | $0.67 | 2025-11-20 | 2025-11-20 |

| September 30, 2025 | $0.67 | 2025-08-21 | 2025-08-21 |

| June 30, 2025 | $0.67 | 2025-05-23 | 2025-05-23 |

| March 31, 2025 | $0.63 | 2025-02-27 | 2025-02-27 |

| December 31, 2024 | $0.63 | 2024-11-21 | 2024-11-21 |

Dividends Summary

- Consistent Payer: Marriott International Class A Common Stock has rewarded shareholders with 78 dividend payments over the past 21 years.

- Total Returned Value: Investors who held MAR shares during this period received a total of $19.59 per share in dividend income.

- Latest Payout: The most recent dividend of $0.67/share was paid 23 days ago, on December 31, 2025.

- Yield & Schedule: MAR currently pays dividends quarterly with an annual yield of 0.82%.

- Dividend Growth: Since 2004, the dividend payout has grown by 793.3%, from $0.07 to $0.67.

- Dividend Reliability: MAR has maintained or increased its dividend for 15 consecutive payments.

Company News

Crestline Hotels & Resorts has been selected by Apple Hospitality REIT to manage two 200-guestroom hotels along Orlando's International Drive: SpringHill Suites by Marriott and Fairfield by Marriott, both near SeaWorld and other major attractions. The partnership leverages Crestline's management expertise and Apple Hospitality REIT's real estate ...

Questex's Vibe Conference has announced finalists for the 2026 Vibe Vista Awards, recognizing excellence in on-premise beverage programs across leading hospitality chains, cruise lines, airlines, and hotels. Award winners will be announced at Vibe Conference 2026 in San Diego on February 23-25.

The global boutique hotels market expanded from $71.56 billion in 2025 to $76.30 billion in 2026, with projected growth to $114.86 billion by 2032 at a 6.99% CAGR. Market growth is driven by guest personalization, digital innovation, sustainability initiatives, and adaptive design models. Key trends include investment in frictionless booking, hyp...

The global Hotels, Resorts, & Cruise Lines market is projected to grow from $133.11 billion in 2026 to $189.09 billion by 2032 at a CAGR of 5.96%. Major industry players are increasing technology investments in digital transformation, sustainability, and guest personalization. However, tariff dynamics and supply chain pressures present operationa...

Daniel Sparks recommends Marriott International as a strong dividend stock despite its modest 0.8% yield. The company's asset-light business model, growing loyalty program (260 million members), and significant share buybacks ($4 billion expected for full year) support long-term dividend and stock price growth. However, investors should note the ...